About Authors:

About Authors:

Manthan Shah

D.Pharm, B.Pharm, MBA(Marketing & Finance)

Assistant PMT

Sohm India Pvt Ltd

manthanshah.leo@gmail.com

INTRODUCTION

The first day of January 2005 marked a dramatic turning point in the history of India. By deliberately excluding pharmaceutical products from patent protection for the previous 34 years, India became a world leader in high-quality generic drug manufacturing. But India’s entry into the global economy at the end of the 20th century, as evidenced by membership in the World Trade Organization (WTO), compelled the nation to once again award patents on drugs. Moreover, India henceforth would have to apply internationally-accepted criteria for granting patents, and the term of its patents would have to extend twenty years beyond filing.

For an emerging superpower still mired in immense domestic poverty and public health crises, these and other fundamental changes to India’s patents regime did not come quickly nor without controversy. Their implementation remains uncertain. It is far too early to empirically establish, for example, whether India’s adoption of stronger patent laws will catalyze a significant shift from generic drug manufacturing to indigenous pharmaceutical innovation[1]. What is clear, however, is that the implications of India’s tumultuous patent system transformation will be felt not only within India but also around the globe. From the perspective of millions suffering worldwide from life threatening diseases, many of whom previously benefited from the low-cost products of India’s thriving generic drug manufacturing sector, the introduction of a pharmaceutical product patents regime in India is viewed as an international healthcare tragedy. That view is the extreme. The true impact of the changes will turn on implementation. Eighteen months into the new patents regime, India is actively exploiting the flexibilities inherent in the WTO’s Agreement on Trade-Related Aspects of Intellectual Property (TRIPS). These flexibilities allow India to balance the need to protect its public from the social costs of stronger patent protection while at the same time provide the necessary incentives for domestic research and development in medicines and healthcare. The transformation of the nation’s patent regime is entirely consistent with a burgeoning domestic pharmaceutical and biotech industry that is beginning to invent rather than merely reverse-engineer. The traditional Indian view of patent protection as a moral wrong antithetical to public health is evolving to a more complex understanding—still in its formative implementation stages, to be sure—that a patent system can be designed and implemented to spur domestic innovation while at the same time maintaining affordable public access to life-saving patented medicines[2]. The first major comparative analysis of India’s newly strengthened patents regime, i.e., the Patents Act, 1970, as last amended in 2005 (hereinafter “India Patents Act, 1970 (2005)”).5 These evaluates the first eighteen months of the new regime’s operation, drawing not only from published literature but also from original fact finding, data gathering, and interviews conducted in India with Indian Patent Office officials, Indian pharmaceutical industry representatives, Indian patent attorneys, and Indian patent law academics.

Reference Id: PHARMATUTOR-ART-1357

CHAPTER 2: GLOBAL AND INDIAN PHARMACEUTICAL MARKET

CURRENT GLOBAL PHARMACEUTICAL MARKET

Pharmaceutical products consist of two main components— the active pharmaceutical ingredient (API) or bulk drug and the formulation (i.e., a sui final dosage form). Generally, APIs are either produced by chemical synthesis or are of plant, animal, or biological origin. Patents are critical aspects in the development and marketing of pharmaceutical products. A patent can be obtained for a new drug molecule, a new indication for an existing molecule, or for a new drug delivery system of an existing product. The World Trade Organization (WTO) has decided to enforce a product patent life of 20 years in all countries. In other words, if drug development and FDA approval takes approximately 10 years from the first disclosure of the molecule, a pharmaceutical company gets only 10 years of exclusivity to market the formulation. The excessive cost of drug development forces drug prices to remain high while the drugs are protected by patents. In addition, not every project leads to a marketed product, so successfully marketed products must cover the costs incurred for the failed projects. The current pharmaceutical market is worth more than $317 billion . The major contributing regions are the United States, Japan, and Europe. GlaxoSmithKline, Pfizer, and Merck are the top three companies in the pharmaceutical market,with annual sales of $23.5, 22.6, and 20.2 billion, respectively. Pfizer has the largest R&D budget, which is hovering at $4.4 billion. Most of the major US pharmaceutical companies showed double-digit growth in 1999 . Drug prices vary from country to country. Citizens of developing countries cannot afford expensive medicines that are under patent. Multinational companies (MNCs) must either choose to sell a product at a low price in these countries or face the challenge of piracy or parallel trade. Types of diseases in Third World countries may vary from those in developed nations. However, because of the lack of sizable profits from distributing pharmaceutical products in Third World countries, MNCs are reluctant to conduct research to develop new drug molecule to treat diseases.

THE PHARMACEUTICAL MARKET IN INDIA

Historical background. India received independence from Britain in 1947. In the early years following that event, MNCs were allowed to export drugs—mainly low-priced generics and a few high-priced specialty items.When the Indian government increased pressure against the import of finished products, MNCs developed formulation units in India and exported only bulk drugs to that country. In the early 1960s, the Indian government encouraged the indigenous manufacture of bulk drugs. In the following decade the Indian patent act prevented the granting of product patents for substances used in foods and pharmaceuticals. Only process patents were allowed for five years from the date of granting a patent or seven years from the date of filing the patent. Drug price control order (DPCO) was introduced during the same period to prevent undue profiteering from essential medicines. MNCs were compelled to reduce their holdings to 40% in their Indian ventures. In the 1980s–1990s, domestic pharmaceutical companies flourished. As a result, the market share of MNCs fell to the current 35%, down from 75% in 1971.

TYPES OF DRUG SYSTEMS IN INDIA

Ancient civilization allowed India to develop various kinds of medical and pharmaceutical systems. In addition to the allopathic system, which is prevalent in the United States, Japan, and Europe, the following types of medical and pharmaceutical systems are used by the Indian people:

Ayurveda: Ayurveda translates as the “science of life.” It encompasses fundamentals and philosophies about the world and life, diseases, and medicines. The knowledge of ayurveda is compiled in Charak Samhita and Sushruta Samhita. The curative treatment lies in drugs, diet, and general mode of life.

Siddha: The siddha system is one of the oldest Indian systems of medicine. Siddha means “achievement.” Siddhas were saintly figures who achieved healing through the practice of yoga. The siddha system does not look merely at a disease but takes into account a patient’s age, sex, race, habits, environment, diet, physiological constitution, and so forth. Siddha medicines have been effective in curing some diseases, and further work is needed to truly understand why this system works.

Unani: The unani system originated in Greece and progressed to India during the medieval period. It involves promotion of positive health and prevention of disease. The system is based on the humoral theory, i.e., the presence of blood, phlegm, yellow bile, and black bile. A person’s temperament is accordingly expressed as sanguine, phlegmatic, choleric, or melancholic. Drugs derived from plant, metal, mineral, and animal origin are used in this system.

Homeopathy: Homeopathy flourished in Germany in the seventeenth and eighteenth centuries. In India, it is one of the commonly used methods to treat diseases. Physicians in the time of Hippocrates (400 BC) first observed that some substances produce symptoms of conditions that they were then used to treat. On the basis of this finding, a homeopathic medicinal agent, which can produce artificial symptoms in healthy human beings, can cure a similar set of symptoms of natural diseases. It normally uses a single medicine, and the dosage is minimal— just enough to cure the disease.

Yoga and naturopathy: Yoga and naturopathy are ways of life. In naturopathy, one applies simple laws of nature. It advocates proper attention to eating and living habits. It also involves hydrotherapy, mud packs, baths, massage, and so forth. Yoga consists of eight components: restraint, observance of austerity, physical postures, breathing exercises, restraining of the sense organs, contemplation, meditation, and samadhi. Increasing interest exists in revisiting these ancient drug systems. The Department of Indian Systems of Medicines and Homeopathy was established in 1995 as a separate department in the Ministry of Health and Family Welfare. One of the organization’s goals is to prepare standards for ayurvedic, unani, sidhha, and homeopathy drugs. Good manufacturing practices for ayurvedic drugs is at the final stage. The department is actively pursuing a proposal to establish a medicinal-plant board to enhance the availability of quality raw materials, prepare a database of medicinal plants, and collect information from ancient texts.

Biotechnology Generics

Firms based in India and China could be among the first to bring biogenerics (generic versions of biological products) to the regulated markets and faster than expected. The first biogeneric product was approved by the European Medicines Agency (EMEA) which refers to these products as “biosimilars,” in April 2006. IMS estimates that biotechnology products accounted for 10 percent of global pharmaceutical sales in 2004, or about $55 billion in worldwide sales for the year. By 2003, the U.S. accounted for 62 percent of the global biotech drugs market, while in that year Japan's share of the total had fallen to 7 percent from 28 percent in 1994.20 Patents on the first generation of blockbuster biopharmaceuticals are beginning to expire, and the high cost of these products means the generic versions will find large markets among hard-pressed governments and other payers. Sales of biogenerics are flourishing in the unregulated markets. The only regulated-market approvals so far are in Australia, granted in October 2004 for the recombinant DNA growth hormone Omnitrope, manufactured by Sandoz, as well as in the EU, granted in April 2006. No U.S. approvals are likely until 2009, says market research company Data monitor. The company has identified six key product classes-insulin, human growth factor, epoetin, colony stimulating factors (CSFs), interferon alpha and interferon beta-as being at risk from biogeneric versions of these products and estimates that global sales of the latter should total over $2 billion by 2010. An early beneficiary when the regulated markets finally establish frameworks for biogenerics is likely to be Wockhardt. This pharmaceutical and biotechnology company was one of the first Indian drug manufacturers to enter the European market, achieving this through a series of acquisitions; it now has three subsidiaries in Europe, acquiring first The Wallis Laboratory in 1997 and CP Pharmaceuticals in 2003, both in the UK, then Esparma of Germany in 2004. Biopharmaceuticals are central to Wockhardt's growth strategy, and the firm expects this area of its business to take off in 2006. Reporting at the end of December 2005, it says it has more than 55 registrations for biopharmaceuticals pending, and 26 approvals in 18.

Biotechnology

In 2003-04, biopharmaceuticals accounted for 60 percent of India's total biotechnology market, which was worth an estimated $709 million-up 39 percent over the previous period. Investment in the sector was up 26 percent to $137 million-and exports accounted for 56 percent of industry revenues. The domestic biopharmaceuticals sector grew 38.5 percent and had the largest local market share, at 76 percent, followed by bioagriculture at 8.4 percent, bioservices at 7.7 percent, and industrial products at 5.5 percent and bio-informatics at 2.5 percent.25 With 200 biotech companies and total revenues of $500 million annually, India's biotechnology sector is still in the relatively early stages of development. However, it is growing fast, with an initial emphasis on vaccines and bioservices. The industry is situated mainly in Karnataka, although there are operations in Andra Pradesh, Hyderabad, Kerala, Maharashtra and West Bengal. The top 10 players in terms of revenues in 2004 were Biocon, Serum Institute of India, Panacea Biotec, Nicholas Piramal, Novo Nordisk, Venkateshwara Hatcheries, Wockhardt, GSK, Bharat Serums & Vaccines, and Eli Lilly & Co, reports Burrill & Co, the U.S.-based life sciences merchant bank. As is generally the case worldwide, most biotech companies in India have developed along the contract or collaborative research models.

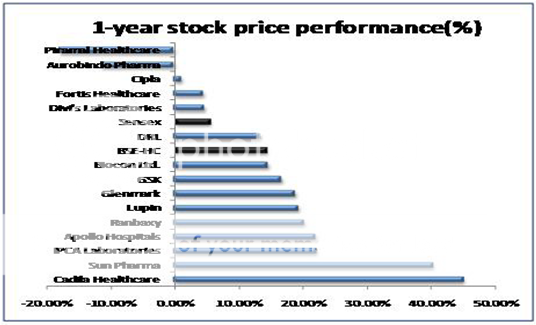

MAJOR PLAYERS IN THE PHARMACEUTICAL INDUSTRY IN INDIA

Two types of companies exist in the Indian pharmaceutical sector: companies of Indian origin (domestic) and foreign MNCs.GlaxoSmithKline, Cipla, Dr. Reddy’s Laboratories, and Ranbaxy are the top four companies in terms of gross sales. Other companies’ sales values are very similar, and the rankings can change with time. The top MNCs with a presence in India are Glaxo- SmithKline,Hoechst Marion Roussel, Knoll Pharma, and Pfizer. Approximately 20,000 pharmaceutical units exist in India. Ranbaxy, the leading domestic company, reported sales of Rs. 1745.9 crores ($356.3 million, assuming that $1.00 _ Rs 49) during 2000. Glenmark Pharmaceuticals, Cadila Healthcare, Ajanta Pharma, and Elder Pharmaceuticals are among other upcoming companies.

EFFORTS BY THE INDIAN GOVERNMENT

The Indian government is encouraging private and public sectors as well as foreign investors to increase investments in pharmaceutical R&D. Some positive steps taken by the Indian government in recent years include

? Recognition of the pharmaceutical industry as a knowledge-based industry

? Reduction in interest rates for export financing

? Additional tax deductions for R&D expenses

? Reduction in the price control of pharmaceuticals.

As an example, the import duty surcharge of 3.5% on vaccines and life-savings drugs has been removed. A 10% surcharge on custom duty has also been scuttled (9). Small-scale industry exemptions have led to the proliferation of small formulation manufacturers and low-cost drug manufactures. DPCO came into existence in 1970 and thereafter was revised in 1979, 1987, and 1995. DPCO controls the domestic prices of major bulk drugs and their formulations (10). In 1970, all drug prices were controlled by DPCO. The numbers of drugs ruled by price controls were 370, 143, and 76 in 1979, 1987, and 1995, respectively. DPCO oversees all formulations containing bulk drugs specified in the first schedule. DPCO 1995 gives a uniform maximum allowable postmanufacturing expense (MAPE) of 100% as compared with earlier MAPE of 75% for some of\ the drugs.

EFFORTS BY THE INDIAN PHARMACEUTICAL INDUSTRY

The IPI, seeking to take full advantage of benefits offered by the government, has been allocating money to R&D. Its focal points are drug discovery, development of drug delivery systems, biotechnology, and bioinformatics. Companies are reevaluating their strengths and emphasizing product segments that are profi to the company. Many companies are trimming their portfolios to focus on particular therapeutic segments. Pharmaceutical marketing is also changing rapidly, and pharmaceutical companies are making elaborate marketing efforts. Companies such as Sun Pharma, Nicholas Piramal, and Dr. Reddy’s Laboratories have opted for brand/company acquisition to increase therapeutic reach and market penetration. Such specialization would make the entry of MNCs difficult. Some theorize that companies with a strong marketing force would be attractive for possible take-over.Many pharmaceutical companies are entering into marketing arrangements such as Hoechst Marion’s agreement with Nicholas Piramal and Ranbaxy’s pact with Cipla, Glaxo, and Hoechst Marion. Recent mergers and acquisitions include Nicholas Piramal’s acquisition of Roche Products, a company mainly involved in diagnostic products and Zydus Cadila’s acquisition of German Remedies in India. Sanofi Synthelabo, the second largest pharmaceutical company in France, will buy out Ahmedabad-based Torrent Pharmaceuticals.Very recently, Dr. Reddy’s Laboratories signed a definitive agreement to acquire 100% of Meridian Healthcare and BMS Laboratories, whose primary business is to manufacturing and marketing generic products in worldwide.

THE CHANGING PRESCRIPTION[3]

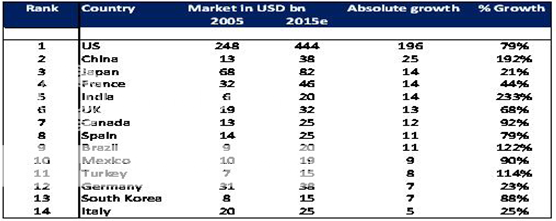

Figure 1[4]

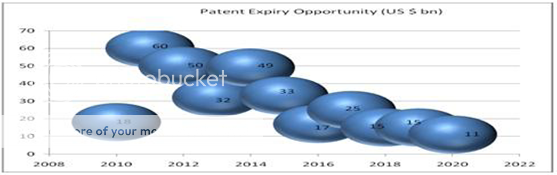

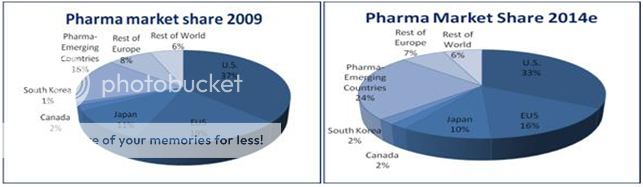

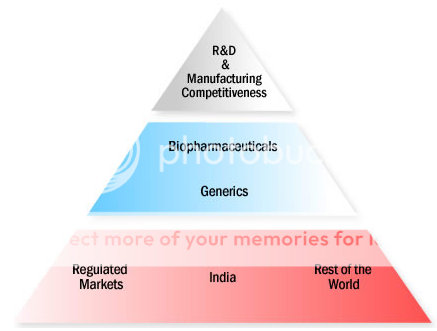

As per WTO, from the year 2005, India granted product patent recognition to all new chemical entities (NCEs) i.e., bulk drugs developed then onwards. This introduction of product patent regime from January 2005 is leading into long-term growth for the future which mandated patent protection on both products and processes for a period of 20 years. Under this new law, India will be forced to recognize not only new patents but also any patents filed after January 1, 1995. Under changed environment, the industry is being forced to adapt its business model to recent changes in the operating environment. Corporate Catalyst India India’s Pharmaceutical Industry Indian pharmaceutical industry is mounting up the value chain. From being a pure reverse engineering industry focused on the domestic market, the industry is moving towards basic research driven, export oriented global presence, providing wide range of value added quality products and services, innovation, product life cycle management and enlarging their market reach. The old and mature categories like anti-infectives, vitamins, analgesics are de-growing while, new lifestyle categories like Cardiovascular, Central Nervous System (CNS), Anti Diabetic are expanding at double-digit growth rates. The Indian companies are putting their act together to tap the generic drugs markets in the regulated high margin markets of the developed countries. The US market remains to be the most lucrative market for the Indian companies led by its market size and the intensity of blockbuster drugs going off patent. An estimated US$45 billion of drugs expected to go off patent by 2007 in US alone. The Indian pharmaceutical industry is also getting increasingly U.S. FDI compliant to harness the growth opportunities in areas of contract manufacturing and research. Indian companies such as Ranbaxy, Sun Pharma, and Dr. Reddy's are increasingly focusing on tapping the U.S. generic market.

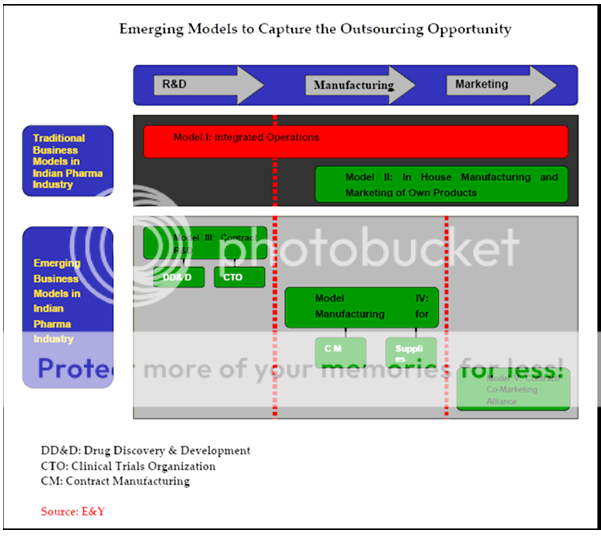

Outsourcing in the fields of R&D and manufacturing is the next best event in the pharmaceutical industry. Spiraling cost, expiring patents, low R&D cost and market dynamics are driving the MNCs to outsource both manufacturing and research activities. India with its apt chemistry skills and low cost advantages, both in research and manufacturing coupled with skilled manpower will attract a lot of business in the days to come. The Indian Government's decision to allow 100 percent foreign direct investment into the drugs and pharmaceutical industry is expected to aid the growth of contract research in the country. MNCs in India is facing the problem of having a very high Drugs Price Control Order (DPCO) coverage, weakening their bottom lines as well as hindering their growth through the launch of new products. DPCO coverage is expected to be diluted further in the near future benefiting the MNCs.

CHAPTER 3

EMERGING TRENDS

EMERGING TREND

The Indian pharmaceutical industry is now discovering new opportunities of growth in clinical research, contract research, manufacturing and innovation opportunities. This path can lead the Indian pharmaceutical industry to huge success endeavors.

Indian Pharmaceutical Industry: Post 2005 scenario

Global pharmacos expected to launch 200-250 new drugs over next 8-10 years totaling an estimated US$ 3-5 billion FDI inflow grew over six fold from US$ 60.7 mn in 2003 to US$ 340 mn, in fiscal year 2004 Bristol Myers Squibb, Boehringer Ingelheim and Eisai without Indian presence earlier, have made recent foray Indian firms tying up with foreign companies to in-license drugs Corporate Catalyst India India’s Pharmaceutical Industry.

Figure 2[5]

Research & Development

Research & Development is the key to the future of pharmaceutical industry. The pharmaceutical advances for considerable improvement in life expectancy and health all over the world are the result of a steadily increasing investment in research. There is considerable scope for collaborative R & D in India. India can offer several strengths to the international R & D community. These strengths relate to availability of excellent scientific talents who can develop combinatorial chemistry, new synthetic molecules and plant derived candidate drugs. The R & D expenditure by the Indian pharmaceutical industry is around 1.9 per cent of the industry’s turnover, which is a little low as compared to foreign research based pharmaceutical companies. However, now that India is entering into the Patent protection area, many companies are spending relatively more on R & D. When it comes to clinical evaluationat the time of multi-center trials, India is providing a strong base considering the real availability of clinical materials in diverse therapeutic areas. According to a survey by the Pharmaceutical Outsourcing Management Association and Bio/Pharmaceutical Outsourcing Report, pharmaceutical companies are utilizing substantially the services of Contract Research Organizations(CROs). Indian Pharmaceutical Industry, with its rich scientific talents, provides cost-effective clinical trial research. It has an excellent record of development of improved, cost-beneficial chemical syntheses for various drug molecules. Some MNCs are already sourcing these services from their Indian affiliates.

Product development

For years, firms have made their ways into the global market by researching generic competitors to patented drugs and following up with litigation to challenge the patent. This approach remains untouched by the new patent regime and looks to increase in the future. Corporate Catalyst India India’s Pharmaceutical Industry However, those that can afford it have set their sights on an even higher goal: new molecule discovery. Although the initial investment is huge, companies are lured by the promise of hefty profit margins and the recognition as a legitimate competitor in the global industry.

Figure 3[6]

SWOT ANALYSIS OF IPI

Strength

Most people in India, especially those who are educated and have advanced degrees, are fluent in English. This aptitude allows them to communicate with most of the outside world, which is an important asset to the IPI. The health statistics of India make it clear that India produces a sufficient number of medical and pharmacy graduates, which contributes to the strengthening of the IPI. The Patent Act and Drug Price Control Order of the 1970s forced MNCs to shrink their operations in India, thus providing space for indigenous pharmaceutical companies to expand in the local market. As a result, in the past two to three decades domestic pharmaceutical companies have established operations and are self sufficient in all aspects. For example, Cipla Limited could provide the generic version of the AIDS triple cocktail to impoverished South African people at $350/patient/year or at a price that is one-thirtieth its cost in the United States. Indian patent laws allowed local companies to set up opera operations to produce bulk drugs that are still under patent, by various synthetic routes. The prevalence of this reverse engineering is controversial, but it suggests that the IPI’s chemists have a strong showing in organic/ medicinal chemistry. The IPI’s tremendous potential to produce bulk drugs will be a major asset in future drug discovery programs. Highly educated people as well as low labor costs are the major strengths of the IPI. Any pharmaceutical industry needs employees from the fields of organic chemistry, biochemistry, pharmacology, pharmacokinetics, pharmaceutical science, analytical chemistry, and so forth.With a very well-developed and diverse education system, India produces students who can meet these requirements. Banglore is considered to be the Silicon Valley of India. The Indian computer industry is on par with its American counterpart, and many companies in the world depend upon Indian programmers to develop complex software. The use of computers in the pharmaceutical industry is increasing, and in particular they are being applied to data management and drug discovery programs. Thus, collaboration between the computer and pharmaceutical industries will help drug discovery and development programs prosper. The presence of other parallel drug/medical systems also would be a major strength for the IPI. It would provide a vast resource for the development of new drug molecules in the drug discovery programs.

Weakness

Although the IPI is large by Indian standards, on the world market its share is merely 1–2%.

Even if 25% of gross sales are invested in R&D, the IPI’s total R&D budget is comparatively very small. Individual R&D budgets of many US companies probably amount to much more than the cumulative R&D budgets of all the companies in India. Thus, availability of funds is a major weakness of the IPI. Animal experiments are an essential part of pharmaceutical R&D. Every drug molecule must be screened using animals first to determine its efficacy and side or toxic effects. If Indian animal rights activists block the use of animals in R&D experimentation, the IPI will be forced to turn to other countries for animal studies. A great need exists to provide appropriate information to animal activists in India so a balance can be struck between animal rights and human rights. A drug regulatory system is an essential part of the pharmaceutical sector.Drug discovery and drug development are risky, complex, and not fully understood. The Indian regulatory system is not set up to accomodate the drug discovery/developmentvprocesses and therefore does not have the proper infrastructure,venough manpower, or financial support to effectively move drug development operations forward. As a result, one might expect delays in the approval process. The American pharmaceutical industry has entered the era of pharmacogenomics and is venturing into the development of drug therapy tailored to individuals. Likewise, the Indian pharmaceutical industry is investing significant funds in biotechnology and genomics. These fields are capital consum-ing and have no guarantee of success. The biotech industry needs scientists who understand these disciplines, but it is not easy to attract qualified scientists and businessmen from abroad to work in India. Spending valuable resources in this area of science, which is in its infancy, can be suicidal to the IPI. Venture capitalists would do well to invest their money only on those projects whose success is guaranteed. Gaining FDA approval of a drug can be a lengthy process. The organization has just enough manpower to oversee approval of products from US-based companies. The IPI’s efforts to seek approval to market drugs in the United States could be time consuming because of FDA constraints, and the approval process could be a major bottleneck for India’s drug development industry. The infrastructure in India is good but could be improved. The development of infrastructure is a key to success, and the IPI must take more definitive steps to overcome this weakness.

Figure 4[7]

OPPORTUNITIES

A patent is granted to an invention that is novel, nonobvious, and useful. The IPI has a clear opportunity to be part of the international patent community in the acquisition of patents. This process will stimulate economic development, provide job opportunities, and help India build a global reputation as a nation with a strong scientific community. It will also make modern medicines available to the entire Indian population. More important, indigenous R&D activities will help domestic companies discover drugs to treat tropical diseases. In the pharmaceutical arena, patents can be granted for new molecules, new medical indicationsfor an existing molecule, new ways to administer an existing molecule, or modification of an existing formulation with added value. Because India will not be able to produce the huge amount of capital needed to discover new drug molecules, it may be prudent to consider issuing patents for “Swiss-type” claims for new therapeutic uses of known molecules. Low manufacturing costs and process skills are the IPI’s forte, and India would do well to make use of this important opportunity. As it develops its infrastructure, the IPI can look into economies of scale.Merging with a complementary domestic or international company may provide sufficient funding and resources to manufacture formulations and bulk drugs on a large scale, which would decrease the cost of manufacture. This would help make bulk drug or formulation costs competitive in the world market,which then would boost the amount of exports. Focused R&D and the development of centers for clinical trials in India would allow the IPI to discover new drugs for diseases observed in tropical conditions. Such drugs could be marketed both in India and in neighboring countries with a similar tropical climate. For the first three years of the ninth five-year plan, the growth rate for the Indian economy was 6.2% To meet the target of 6.5%, the economy must grow at 7.2% during the next two years. The target growth rate for the tenth five-year plan is 9%. This sizeable increase is a clear-cut indication of the anticipated future growth of the Indian economy, which could provide good opportunities to the IPI.

Threats

Many more countries will be complying with the terms of patent laws in 2005. It means that, like India, many countries are preparing for 2005 and will be competing to market various pharmaceuticals. The Indian pharmaceutical market may face the threat of the dumping of bulk drugs and formulations by neighboring countries. The IPI would be compelled to compete with multinationals in 2005, and it remains to be seen how many companies actually will survive the competition . Industrialization and environmental factors must be considered, and if proper measures are not taken up front, business growth eventually will be hampered.

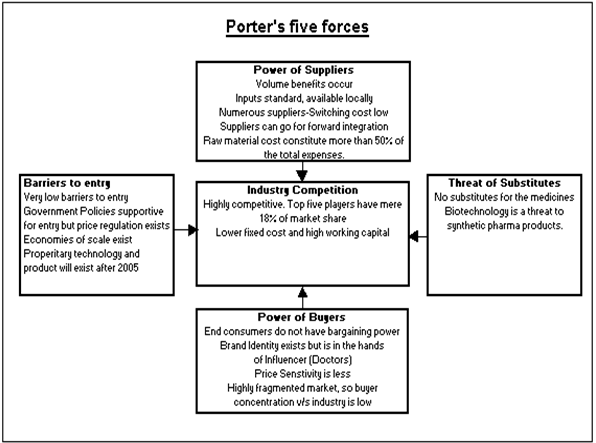

PORTER FIVE FORCE MODEL FOR INDIAN PHARMACEUTICAL INDUSTRY

INDUSTRY COMPETITION

* Most competitive industries in the country with as many as 10,000 different players.

* Top player in the country has only 6% market share and top five have 18%.

* High growth prospects.

* Very low entry barriers.

* Fixed cost requirement is low and need for working capital is high.

BARGAINING POWER OF BUYER

* End user of the product is different from the influencer (read Doctor).

* Consumer has no choice but to buy what doctor says.

* Buyers are scattered and they as such does not wield much power in the pricing of the products.

BARRIERS TO ENTRY

* Most easily accessible industries for an entrepreneur in India.

* Capital requirement for the industry is very low, creating a regional distribution network is easy.

* Point of sales is restricted in this industry in India.

* Creating brand awareness and franchisee amongst doctors is the key for long-term survival.

* Quality regulations by the government may put some hindrance for establishing new manufacturing operations.

* Impending new patent regime will raise the barriers to entry.

THREAT OF SUBSTITUTE

* One of the great advantages of the pharma industry.

* Demand for pharma products continues and the industry thrives.

* Key reasons for high competitiveness in the industry is that as an on going concern.

* Key reasons for high competitiveness in the industry is that as an on going concern.

Chapter 4: INTELLECTUAL PROPERTY RIGHTS

INTELLECTUAL PROPERTY RIGHTS (IPR)[8]

Intellectual property rights as a collective term includes the following independent IP rights which can be collectively used for protecting different aspects of an inventive work for multiple protection:-

* Patents

* Copyrights

* Trademarks

* Registered ( industrial) design

* Protection of IC layout design,

* Geographical indications, and

* Protection of undisclosed information

Nature of Intellectual Property Rights

IPR are largely territorial rights except copyright, which is global in nature in the sense that it is immediately available in all the members of the Berne Convention. These rights are awarded by the State and are monopoly rights implying that no one can use these rights without the consent of the right holder. It is important to know that these rights have to be renewed from time to time for keeping them in force except in case of copyright and trade secrets. IPR have fixed term except trademark and geographical indications, which can have indefinite life provided these are renewed after a stipulated time specified in the law by paying official fees. Trade secrets also have an infinite life but they don’t have to be renewed. IPR can be assigned, gifted, sold and licensed like any other property. Unlike other moveable and immoveable properties, these rights can be simultaneously held in many countries at the same time. IPR can be held only by legal entities i.e., who have the right to sell and purchase property. In other words an institution, which is not autonomous may not in a position to own an intellectual property. These rights especially, patents, copyrights, industrial designs, IC layout design and trade secrets are associated with something new or original and therefore, what is known in public domain cannot be protected through the rights mentioned above. Improvements and modifications made over known things can be protected. It would however, be possible to utilize geographical indications for protecting some agriculture and traditional products.

Patents

A patent is an exclusive right granted by a country to the owner of an invention to make, use, manufacture and market the invention, provided the invention satisfies certain conditions stipulated in the law. Exclusive right implies that no one else can make, use, manufacture or market the invention without the consent of the patent holder. This right is available for a limited period of time. In spite of the ownership of the rights, the use or exploitation of the rights by the owner of the patent may not be possible due to other laws of the country which has awarded the patent. These laws may relate to health, safety, food, security etc. Further, existing patents in similar area may also come in the way. A patent in the law is a property right and hence, can be gifted, inherited, assigned, sold or licensed. As the right is conferred by the State, it can be revoked by the State under very special circumstances even if the patent has been sold or licensed or manufactured or marketed in the meantime. The patent right is territorial in nature and inventors/their assignees will have to file separate patent applications in countries of their interest, along with necessary fees, for obtaining patents in those countries. A new chemical process or a drug molecule or an electronic circuit or a new surgical instrument or a vaccine is a patentable subject matter provided all the stipulations of the law are satisfied.

The Indian Patent Act

The first Indian patent laws were first promulgated in 1856. These were modified from time to time. New patent laws were made after the independence in the form of the Indian Patent Act 1970. The Act has now been radically amended to become fully compliant with the provisions of TRIPS. The most recent amendment were made in 2005 which were preceded by the amendments in 2000 and 2003. While the process of bringing out amendments was going on, India became a member of the Paris Convention, Patent Cooperation Treaty and Budapest Treaty. The salient and important features of the amended Act.

Definition of invention

A clear definition has now been provided for an invention, which makes it at par with definitions\ followed by most countries. Invention means a new product or process involving an inventive step and capable of industrial application. New invention means any invention or technology which has not been anticipated by publication in any document or used in the country or elsewhere in the world before the date of filing of patent application with complete specification i.e., the subject matter has not fallen in public domain or it does not form part of the state of the art. Inventive step means a feature of an invention that involves technical advance as compared to existing knowledge or having economic significance or both and that makes the invention not obvious to a person skilled in the art. capable of industrial application means that the invention is capable of being made or used inan industry

Novelty

An invention will be considered novel if it does not form a part of the global state of the art. Information appearing in magazines, technical journals, books, newspapers etc. constitute the state of the art. Oral description of the invention in a seminar/conference can also spoil novelty. Novelty is assessed in a global context. An invention will cease to be novel if it has been disclosed in the public through any type of publications anywhere in the world before filing a patent application in respect of the invention. Therefore it is advisable to file a patent application before publishing a paper if there is a slight chance that the invention may be patentable. Prior use of the invention in the country of interest before the filing date can also destroy the novelty. Novelty is determined through extensive literature and patent searches. It should be realized that patent search is essential and critical for ascertaining novelty as most of the information reported in patent documents does not get published anywhere else. For an invention to be novel, it need not be a major breakthrough. No invention is small or big. Modifications to the existing state of the art, process or product or both, can also be candidates for patents provided these were not earlier known. In a chemical process, for example, use of new reactants, use of a catalyst, new process conditions can lead to a patentable invention.

Inventiveness (Non-obviousness)

A patent application involves an inventive step if the proposed invention is not obvious to a person skilled in the art i.e., skilled in the subject matter of the patent application. The prior art should not point towards the invention implying that the practitioner of the subject matter could not have thought about the invention prior to filing of the patent application. Inventiveness cannot be decided on the material contained in unpublished patents. The complexity or the simplicity of an inventive step does not have any bearing on the grant of a patent. In other words a very simple invention can qualify for a patent. If there is an inventive step between the proposed patent and the prior art at that point of time, then an invention has taken place. A mere 'scintilla' of invention is sufficient to found a valid patent. It may be often difficult to establish the inventiveness, especially in the area of up coming knowledge areas. The reason is that it would depend a great deal on the interpretative skills of the inventor and these skills will really be a function of knowledge in the subject area.

Usefulness

An invention must possess utility for the grant of patent. No valid patent can be granted for an invention devoid of utility. The patent specification should spell out various uses and manner of practicing them, even if considered obvious. If you are claiming a process, you need not describe the use of the compound produced thereby. Nevertheless it would be safer to do so. But if you claim a compound without spelling out its utility, you may be denied a patent.

Non patentable inventions

An invention may satisfy the conditions of novelty, inventiveness and usefulness but it may not qualify for a patent under the following situations:

(i) An invention which is frivolous or which claims anything obviously contrary to well established natural laws e.g. different types of perpetual motion machines.

(ii) An invention whose intended use or exploitation would be contrary to public order or morality or which causes serious prejudice to human, animal or plant life or health or to the environment e.g., a process for making brown sugar will not be patented.

(iii) The mere discovery of a scientific principal or formulation of an abstract theory e.g., Raman effect and Theory of Relativity cannot be patented.

(iv) The mere discovery of a new form of a known substance which does not result in enhancement of the known efficacy of that substance or the mere discovery of any new property or new use of a known substance or the mere use of a known process, machine or apparatus unless such a known process results in a new product or employs at least one new reactant. For the purposes of this clause, salts, esters, polymorphs, metabolites, pure form, particle size, isomers, mixtures of isomers, complexes, combinations and other derivatives of known substance shall be considered to be the same substance unless they differ significantly in properties with regard to efficacy.

(v) A substance obtained by a mere admixture resulting only aggregation of the properties of the components thereof or a process for producing such substance.

(vi) The mere arrangement or rearrangement or duplication of features of known devices each functioning independently of one another in a known way. If you put torch bulbs around an umbrella and operate them by a battery so that people could see you walking in rain when it is dark, then this arrangement is patentable as bulbs and the umbrella perform their functions independently.

(vii) A method of agriculture or horticulture. For example, the method of terrace farming cannot be patented.

(viii) Any process for medical, surgical, curative, prophylactic, diagnostic, therapeutic or other treatment of human beings, or any process for a similar treatment of animals to render them free of disease or to increase economic value or that of their products. For example, a new surgical technique for hand surgery for removing contractions is not patentable.

(viii) Inventions relating to atomic energy;

(ix) Discovery of any living thing or non-living substance occurring in nature;

(x) Mathematical or business methods or a computer program per se or algorithms;

(xi) Plants and animals in whole or any part thereof other than microorganisms but including seeds, varieties and species and essentially biological processes for production and propagation of plants and animals;

(xii) A presentation of information;

(xiii) Topography of integrated circuits;

(xiv) A mere scheme or rule or method of performing mental act or method of playing games;

(xv) An invention which, in effect, is traditional knowledge or which is aggregation or duplication of known component or components. Computer program per se as such has not been defined in the Act but would generally tend to mean that a computer program with out any utility would not be patentable. Protection of seeds and new plant varieties is covered under a different Act, which provides a protection for a period of 10 years. Similarly, topography of integrated circuits is protected through yet a different Act.

HISTORICAL EVOLUTION OF PATENT LAW IN INDIA

The development of India’s patents regime mirrors the country’s journey from colonization to independence to global citizen. Three distinct periods can be identified, each of which is detailed below. To summarize, in the first or “colonial” period the British enacted India’s first patent statutes during the latter half of the 19th century. Although India gained its independence from the British in 1947, it was unable to enact its first independently-drafted patent laws until the 1970s due to deep political and policy divisions over the value and role of patent protection in the nation’s developing economy. India’s Patents Act, 1970 entered into force during the second or “post-independence” period. Although modeled on Great Britain’s Patents Act, 1949, the Indian Act incorporated major departures intended to lessen the social costs imposed by largely foreign-owned patents. The Patents Act, 1970 prohibited patents on products useful as medicines and food, shortened the term of chemical process patents, and significantly expanded the availability of compulsory licensing. During the third or “globalization” period from approximately 1986 to the present, India’s participation in the debates over the inclusion of intellectual property within the GATT framework and its eventual entry into the World Trade Organization (WTO), along with its accession to the Paris Convention for the Protection of Industrial Property and the Patent Cooperation Treaty, have compelled significant strengthening of the nation’s patent laws. The implementation of those changes is ongoing, and their anticipated impact remains to be fully seen. Today India stands as a rising global power with a patent system still very much in flux.

Globalization Period

India’s entry onto the global stage as an emerging superpower in the waning days of the twentieth century follows a long process of domestic economic reform. Following independence from Great Britain in 1947, the government of Jawaharlal Nehru, India’s first prime minister, favored “social engineering and economic egalitarianism” which “dampened the spirit of private enterprise and profit.” The British Raj was replaced with the “License Raj,” “a vast system of national and state-level licenses and quotas” which shackled Indian business. Economic conditions did not improve under the subsequent tenure of Prime Minister Indira Gandhi, who nationalized industries, imposed protectionist policies and implemented stiff restrictions on foreign direct investment.The first real movement to a free market for India occurred in 1991, as a result of a balance of payments crisis. Led by then Finance Minister Manmohan Singh (today India’s Prime Minister), the “license raj” was radically reformed. “The rupee was devalued; import controls were dismantled and customs duties slashed; industrial licensing was liberalised and the capital markets opened up. These measures appear to be having the desired effect; today India’s economy is growing at more than eight percent annually. Despite its internal economic reforms, India led the opposition to inclusion of patent and intellectual property rights in a GATT accord for the first three years of the Uruguay Round of negotiations. India and other developing countries viewed the GATT framework as a tool by which wealthy nations would impose strong IPRs as the cost of much-needed access for the developing world to western markets.141 Although initially joined in its opposition by other advanced developing countries such as Brazil, Argentina, and Mexico, when these countries changed their positions India was no longer able to “carry the day alone. India feared restrictions on its exports if it did not accept TRIPS.

CHAPTER 5: COMPANY PROFILE

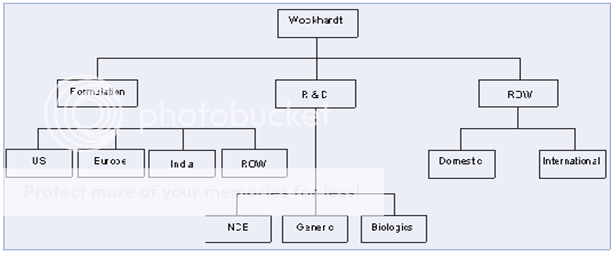

ABOUT THE COMPANY

Company History[9]

Wockhardt, in corporated in 1999, is engaged the pharmaceutical and biotechnology segments. The company has 14 manufacturing unit located in India, France, UK, Ireland and US. Wockhardt's subsidiaries are located in the US, UK, Ireland and France. The company has market presence in formulations, biopharmaceuticals, nutrition products, vaccines and active pharmaceutical ingredients (APIs). The company holds strong position in leading markets such as Europe and United States, which contributes 65% to Wockhardt's revenue. The company has two subsidiaries Negma Lerads, France and Morton Grove Pharmaceuticals, USA. Preparing for change before change beckons. Harnessing the power of innovative research. Providing high-quality medicines for a healthier world. This is our world at Wockhardt. Wockhardt is a global, pharmaceutical and biotechnology company that has grown by leveraging two powerful trends impacting the world of medicine – globalisation and biotechnology. The Company has a market capitalisation of over US$ 1 billion and an annual turnover of US$ 650 million. Wockhardt’s pace of growth and momentum permeates every mindset, system and technology within the organisation. Wockhardt today, is distinguished by a strong and growing presence in the world’s leading markets, with more than 65% of its revenue coming from Europe and the United States. Wockhardt’s market presence covers formulations, biopharmaceuticals, nutrition products, vaccines and active pharmaceutical ingredients (APIs).

The Company has its headquarters in India, and has

*14 manufacturing plants in India, UK, Ireland, France and US

* Subsidiaries in US, UK, Ireland and France

*Marketing offices in Africa, Russia, Central and South East Asia.

WOCKHARDT ADVANTAGE

Wockhardt has a strong track record in acquisition management, with five successful acquisitions in the European market. These acquisitions have strengthened Wockhardt’s position in the high-potential markets of Europe, and have expanded the global reach of the organisation.

Wockhardt’s manufacturing facilities in India, UK, Ireland, France and US have the approval of major regulatory bodies, including US FDA and UK's MHRA, with capabilities for both Finished Dosage Formulations and APIs. The output includes

|

* |

Steriles (Injectables) |

|

* |

Biopharmaceuticals |

|

* |

Orals (Tablets & Liquids) |

|

* |

Topicals (Creams & Ointments). |

Business area

Business Model

Biopharmaceutical

Under this the company has developed a basket of products such as Erythropoietin, Recombinant Human Insulin, Glargine are among others. The company sells 23 products under generic segment in US market. Wockhardt has set up Wockhardt Biotech Park a biopharmaceuticals manufacturing complex located at Aurangabad, India. This complex comprises six manufacturing facilities developed as per USFDA and EMEA standards. It has capacity to serve 10-15% of global demand for major biopharmaceuticals. In new drug discovery area, it has developed number of lead molecules in the anti-infective field. Currently the company has a significant presence in pain management, cough therapy, psychotic drugs, diabetology, vaccines, nutrition and animal health. It has produced brands like Wosulin, Wepox, Proxyvon, Dexolac, Viscodyne, Libotryp, Methycobal and many more.

Outlook

Wockhardt is set to market a patented drug used in treatment of osteoporosis in India. Switzerland-based DSM Nutritional Products, the patent holder of Bonistein, has licensed the drug to Wockhardt. The Indian market for osteoporosis formulations market is over Rs 250 crore, as per data from ORG IMS. This market is growing at 19%. Wockhardt had planned to launch the drug by mid-2009.

In-licensing Strategy[10]

In-licensing has been one of the key growth drivers of our business. These in-licensing deals fulfill our aim to develop breakthrough products in India and also strengthen our existing portfolios. We have in-licensing agreements with number of US and Europe based companies through which we will market 19 products 11 of these have already been introduced during 2008. These belong to therapeutics like dermatology, osteoarthritis and derma-cosmetology, the sectors on which Wockhardt is focusing.

Opportunities

India is one of the few markets in the world where most of the medicines consumed are manufactured locally, mostly by Indian companies. Last year, Indian companies received/filed more ANDAs in the US than companies based in US. The industry (US$ 800 billion) grew by 6% and out of this new business, 85% came from emerging markets. Presently emerging markets contribute 20-25%, however by 2025 it is estimated that they will account for more that 50% of global pharmaceutical sales and India can become a major player in emerging markets given its scientific manpower and established credentials. Wockhardt has been a part of the growing process of the Indian pharmaceutical industry and has been a source of several innovations. We wish to play a significant role in making "Made-in-lndia" products world-renowned. Going ahead, Wockhardt intends to capitalize its global synergies and accelerate the growth momentum both on revenue as well as profit front. The Indian IT story can happen to pharmaceutical in the next 10-15 years.

Challenges

A conducive environment for enhancing the industry's capabilities is imperative. Supporting R&D is one of the driver's for adding value to the business, relaxing price control regime will be the other driver. A price-control mechanism which is cost-plus method was introduced 50 years ago and has now outlived its relevance. To determine the prices of new drugs, Europe uses a value-based system, which is based on the value that medicine provides patient with. We have to do away with price control, especially when there is immense competition in the market and the prices of drugs in India are the most affordable in the world. Today Indian companies are applying for patents and there is need for value-based pricing model in patented products so that it encourages research and innovation. By price control, the government will severely impact the sector's ability to invest in R&D, hurt its competitiveness and retard its expansion in the global generics market.

CRAMS

Wockhardt entered the contract manufacturing space recently. This move will allow optimum utilization of our manufacturing capacity and enable us to position ourself across the entire drug process to MNC pharmaceutical companies. Most of our plants are USFDA-approved and hence we can offer contract manufacturing service for pharmaceutical companies. The global market for contract manufacturing was estimated to be US$ 19 billion and is likely to expand to US$ 31 billion by 2010. Our UK operation is already undertaking significant work in CRAMS. Currently the focus is on sterile manufacturing and in the next few years it will be an integral part of our business. Sterile injectibles represent the fastest growing product segment of the pharmaceutical contract manufacturing industry. This segment was valued at US$ 3 billion. It is anticipated that there will be massive demand for manufacturing sterile syringes, cartridges and vials as biopharmaceutical companies continue to make R&D investments. Asia-Pacific is expected to emerge as the fastest growing region. Market in this region was estimated to be US$ 2 billion and projected to reach US$ 3 billion by 2010 (CAGR of 16%).

Chapter 6

Research METHODOLOGY

RESEARCH GOAL

The goal of financial performance analysis is to determine the efficiency and performance of firm’s working capital management after implementation of” Patent Product”, as reflected in the financial records and reports, to measure the firm’s liquidity, profitability, and other indicators that the business is conducted in a rational and normal way? ensuring enough returns to the shareholders to maintain at least its market value.

Objective Of Study

To identify the probable implication of the New Product Patent Law on Wockhardt Ltd, the Study Process:

1. To examine the impact of the financial components related to working capital in Wockhardt Ltd before and after Product Patent Period

2. To assess Liquidity Position of Wockhardt Ltd before and after Product Patent Period

3. To Assess the Operational Efficiency of Wockhardt Ltd before and after Product Patent Period

4. To Examine the Profitability condition of Wockhardt Ltd before and after Product Patent Period

Database And Methodology

Database

With Pursuance of objective secondary data was sufficient. Database for secondary data this are the sources from were data is collected:

* www.moneycontrol.com

* Annual report of wockhardt Ltd.

* Ace Equity Software

Methodologies

Liquidity Analysis

ü Current Ratio

An indication of a company's ability to meet short term debt obligations? the higher the ratio, the more liquid the company is. Current ratio is equal to current assets divided by current liabilities. If the current assets of a company are more than industry averages, then that company is generally considered to have good short term financial strength. If current liabilities exceed current assets, then the company may have problems meeting its short term obligations. Lower variability in the current ratio indicates proper or efficient management of fund.

ü Liquid Ratio

It is the ratio of liquid assets to current liabilities. Liquid ratio is more rigorous test of liquidity than the current ratio because it eliminates inventories and prepaid expenses as a part of current assets. Usually a high liquid ratio an indication that the firm is liquid and has the ability to meet its current or liquid liabilities in time and on the other hand a low liquidity ratio represents that the firm's liquidity position is not good. Greater variability in the liquid ratio indicates improper or inefficient management of fund in as much.

Analysis Of Operational Efficiency

ü Inventory Turnover Ratio

The inventory turnover ratio gives a general view on the inventories of a company. In order tocalculate it you should divide the annual sales/cost of sales of the company by its inventory. The result represents the turnover or inventory or how many times inventory was used and then again replaced. This number is representative for a one year time period. If the value of the inventoryturnover ratio is low, then it indicates that the management team doesn't do its job properly in managing inventories. This ratio should be compared against industry averages. A low turnover implies poor sales and, therefore, excess inventory. A high ratio implies either strong sales or ineffective buying. High inventory levels are unhealthy because they represent an investment with a rate of return of zero. It also opens the company up to trouble should prices begin to fall.

ü Debtor Turnover ratio

Trade debtors are expected to be converted into cash within a short period of time and are included in current assets. Hence, the liquidity position of concern to pay its short term obligations in time depends upon the quality of its trade debtors. It indicates the rate at which debtors are converted to cash, helps in formulating the credit policy by indicating whether investment in debtors is within limits, and indicates if capital is blocked in slow paying debtors. A high DTR indicates effective credit management but may also mean loss of sales due to a strict credit policy. A low DTR indicates a lenient credit policy, over investment in debtors or slow paying debtors. However, it may also result in higher sales. The higher the value of debtors’ turnover the more efficient is the management of debtors or more liquid the debtors are Similarly, low debtors turnover ratio implies inefficient management of debtors or less liquid debtors. It is the reliable measure of the time of cash flow from credit sales. There is no rule of thumb which may be used as a norm to interpret the ratio as it may be different from firm to firm.

Profitability Analysis

ü Gross Profit Ratio

ü Net Profit Ratio

ü Return On Investment

ANALYSIS OF DATA

LIQUIDITY RATIO

|

RATIO |

DEC01 |

DEC02 |

DEC03 |

DEC04 |

DEC05 |

DEC06 |

DEC07 |

DEC08 |

MAR10 |

MAR11 |

|

CR |

1.94 |

1.42 |

1.5 |

3.35 |

3.46 |

2.93 |

1.5 |

1.02 |

.85 |

.75 |

|

QR |

2.98 |

3.37 |

1.75 |

1 |

1.37 |

2.36 |

1.75 |

1.86 |

1.79 |

1.33 |

|

|

CR |

QR |

|

Total average |

1.872 |

1.956 |

|

Avg Before patent product |

2.334 |

2.094 |

|

Avg after patent product |

1.41 |

1.81 |

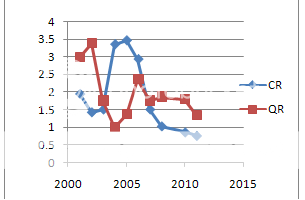

Chart 1 Liquidity Ratio

INTEREPREATION

Most of liquidity ratio were found to have decreased on average in the second period i.e during the new product patent period than during the earlier period. This implied reduced liquidity during the period although the value of components of working capital increased during the second period. This indicates bad management of working capital it can be informed due to economic reforms .the availability of the component of working capital can be found out with ease and it hass created dislocation from the attained position.

PROFITABILITY RATIO

|

RATIO |

DEC01 |

DEC02 |

DEC03 |

MAR04 |

MAR05 |

DEC06 |

DEC07 |

DEC08 |

MAR10 |

MAR11 |

|

GPR |

19.28 |

18.93 |

20.76 |

27.62 |

29.6 |

28.16 |

19.62 |

20.53 |

19.76 |

20.44 |

|

NPR |

16.58 |

15.48 |

18.19 |

23.75 |

23.7 |

17.98 |

16.8 |

-22.55 |

-41.81 |

-7.45 |

|

ROCE |

32.84 |

31.37 |

18.92 |

16.64 |

18.1 |

18.63 |

15.13 |

13.73 |

15.39 |

13.78 |

|

|

GPR |

NPR |

ROCE |

|||||||

|

Total average |

|

|

|

|||||||

|

Avg Before patent product |

|

|

|

|||||||

|

Avg after patent product |

|

|

|

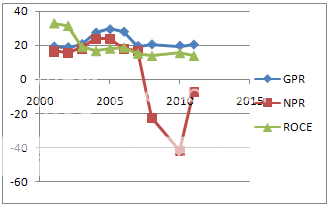

Chart 2 Profitability Ratio

INTEREPREATION

After patent product law the company is facing serious problem of making profit that shows that working capital is not good at all as gross profit is high but net profit is negative .

OPERATIONAL EFFICIENCY

|

Ratio |

DEC01 |

DEC02 |

DEC03 |

MAR04 |

MAR05 |

DEC06 |

DEC07 |

DEC08 |

MAR10 |

MAR11 |

|

ITR |

7.82 |

7.92 |

8.11 |

9.79 |

6.44 |

5.52 |

5.38 |

7.00 |

7.05 |

6.69 |

|

DTR |

5.8 |

5.55 |

5.18 |

5.82 |

5.75 |

5.13 |

4.12 |

3.73 |

4.05 |

4.53 |

|

|

ITR |

DTR |

|||||

|

Total average |

|

|

|||||

|

Avg Before patent product |

|

|

|||||

|

Avg after patent product |

|

|

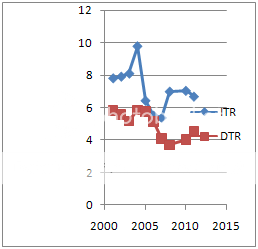

Chart 3 Operational Efficiency Ratio

Chart 3 Operational Efficiency Ratio

INTEREPREATION

The operational efficiency ratio was also found to be reduced in second period. Among Current assets the efficiencies were found to be worsening during the new product patent period this indicates bad management of working capital. Hence new law could not meet its desirable goal.

BROADER SCENARIO

The company saw phenomenal growth in the last decade. For instance, the sales and operating profit went 5 times from 2001 to 2008. The company paid regular dividends and the stock price also went 4 times to Rs 400 in the same period. But this growth had come with a huge increase in total debt. Between 2003 and 2008,Wockhardt acquired seven companies internationally spending about Rs 22 bn. To name a few, it acquired Negma Laboratories in Europe, CP Pharmaceuticals in UK and Esparma & Pinewood Laboratories in Germany. The company seemed ready for the next level of growth. But it was important to note that, its debt had ballooned 14 times from Rs 3 bn to Rs 42 bn in that duration.

Wockhardt raised debt from domestic (mostly banks) as well as international markets. This debt was raised as a mix of secured loans and unsecured loans including the FCCBs (foreign currency convertible bonds). FCCBs are a special type of foreign loans that can later be converted to shares at the predetermined price. Apart from these loans; the company had entered into complex currency option contracts and structured products with banks. This was with a motive to hedge the currency exposure and to bring down its interest cost on foreign loans. But, in the year 2008, talks of a huge loss on these complex contracts surfaced.

CONCLUSION

The company has its manufacturing units in India, Europe and the US.In terms of finding obtained it could be said that Wockhardt Ltd has ineffective credit worthiness, interest rate deregulation, money and debt market reconstruction, cautious ash management and ultimately the competitive endeavour that actually pointed out for better management of working capital of domestic company under financial sector reforms. The company made huge loss in 2008 and 2010 but in 2011 company is covering that loss although it is too early to say but there is one proverb that “morning shows the day”.As per the CDR, the FCCB holders had an option to convert into shares or redeem the bonds. If they chose redemption, it would have been done at a discount of 65%. This meant a capital loss of 65% for an FCCB holder. To avoid it, one of the large state owned banks went ahead with the conversion of FCCBs into preferential shares. But the terms were not favorable to other FCCB holders. In early 2010, they approached the court and filed a winding up petition against Wockhardt. On the other side, unsecured lenders included a couple of foreign banks who sold structured products to the company.

FURTHER STUDIES

By using SPSS we can find out different factor score for Liquidity ratio, Profitability ratio, Operational Efficiency .Here we can clubbed through principal component analysis to form index for different ratio.

References:

•Analysis Of Indian Pharmaceutical Industry By Hemant N Joshi( 2005) With Special Emphasis On opportunities

•The Indian Pharmaceutical Industry : Collaboration For growth By KPMG (2006)

•A Report on Indian Pharmaceutical Industry by Corporate Catalyst India (2009)

•Indian Pharmaceutical Sector: A Prescription for sustained growth By Kaushal S.Sheth 15 October 2011

•Management of Intellectual Property Rights in India By-R Saha Adviser, Department of Science and Technology and Director, Patent Facilitating Centre, Technology Information, Forecasting and Assessment Council, New Delhi(2010)

•Pharmaceutical Contract Manufacturing G/A Report

Journals

•Indian Journal Of Finance Vol-5 August 2011

Websites

•moneycontrol.com

•wockhardt.com

NOW YOU CAN ALSO PUBLISH YOUR ARTICLE ONLINE.

SUBMIT YOUR ARTICLE/PROJECT AT articles@pharmatutor.org

Subscribe to PharmaTutor Alerts by Email

FIND OUT MORE ARTICLES AT OUR DATABASE